Harry Gottlieb

Founder of The Jellyvision Lab

Very few people wake up in the morning thinking, “Oh, good—today’s the day I get to learn about my health insurance options!” So how do you break through to your employees and get your message across?

The answer is simple. Hire a celebrity spokesperson to host your group meetings. Like Jimmy Fallon.

What? Too pricey? Gosh, where are your corporate priorities?

Fine. Well, if you are to cheap to do that can’t afford to do that, you better at least make your benefits communication engaging.

Rule #1 of Benefits Communication: Speak in Plain English

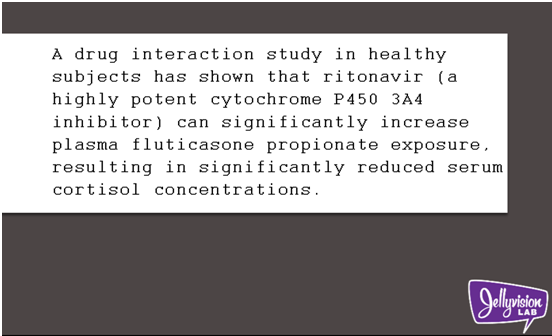

Do you know what this means? Of course you don’t, because this isn’t your area of expertise. This is a little snippet from the warning on one of my prescriptions. Thanks Drug Company! Super helpful! All I need to do now is go to medical school and do my residency as an ENT, and then I’ll totally know what you’re talking about.

Guess what?

This is what your benefit plan descriptions probably sound like to people who aren’t experts in benefits.

Your people don’t want to be educated on insurance terms. Break down your message into basic English, and avoid the temptation to use any benefits jargon. It’s much more pleasant to write the way you speak, and if you do, there’s a better chance that your employees will understand what you’re talking about. And you know who can help you with that: a writer. Lots of people write. And lots of people swim. But not everyone is Michael Phelps. Are you catching my drift? Get a real writer.

Rule #2 of Benefits Communication: Don’t Force Employees to Endure Information They Don’t Care About…at Least Not Right Now

If you try to tackle everyone’s needs at once, you risk boring the pants off everybody. After all, Sally, who’s 24 and single, might not care about the same things as Dale, who’s married with three small children.

Instead of lumping everything into one long session, organize smaller, interest-specific meetings and invite employees to attend the meetings that are relevant for them at the moment. With sessions like “The Basics for Singles” and “The Basics for Families,” you’re bound to have more engaged attendees.

Rule #3 of Benefits Communication: Provide Guidance

If you are offering a choice of medical plans, your employees who take the decision seriously will need to spend time doing independent research and analysis to arrive at the choice that’s right for them. And the employees who want to do that research fit into two categories: they are either big users of medical services or insurance nerds (like you and me). The other 97.3% of your population would rather drink battery acid. Offer guidance to your employees to help them quickly make a decent decision. They don’t care about all of the choices you have to offer—they just want to pick the best plan for them and then stop thinking about it.

Provide some help with what’s a good fit for them based on premium contribution, expected medical expenses, etc. You shouldn’t tell them what to choose, but you can make the decision a lot easier with a bit of clarity and gentle guidance.

A Starting Point for Better Benefits Communication

These three rules are a merely starting point for benefits communications that are way more engaging. There are many things you can do…on your own…the hard way. At Jellyvision, we make it easy for you with ALEX™, Jellyvision’s Virtual Benefits Counselor. ALEX is fast and funny, simple and personalized, and gives employees the guidance they crave.

[Harry presented at our recent HNI University event, Branding Benefits [& Why Traditional Benefits Communication Falls Flat.] Check out the recording to learn more on this topic!

Related Posts:

Manager Liability When it Comes to HR Issues

5 Things Your Social Media Policy Must Do

Reporting Health Insurance on W-2's: Do the Requirements Add Up?

The Science of Wellness Programs

.png?width=69&height=53&name=Acrisure%20Logo%20(White%20Horizontal).png)