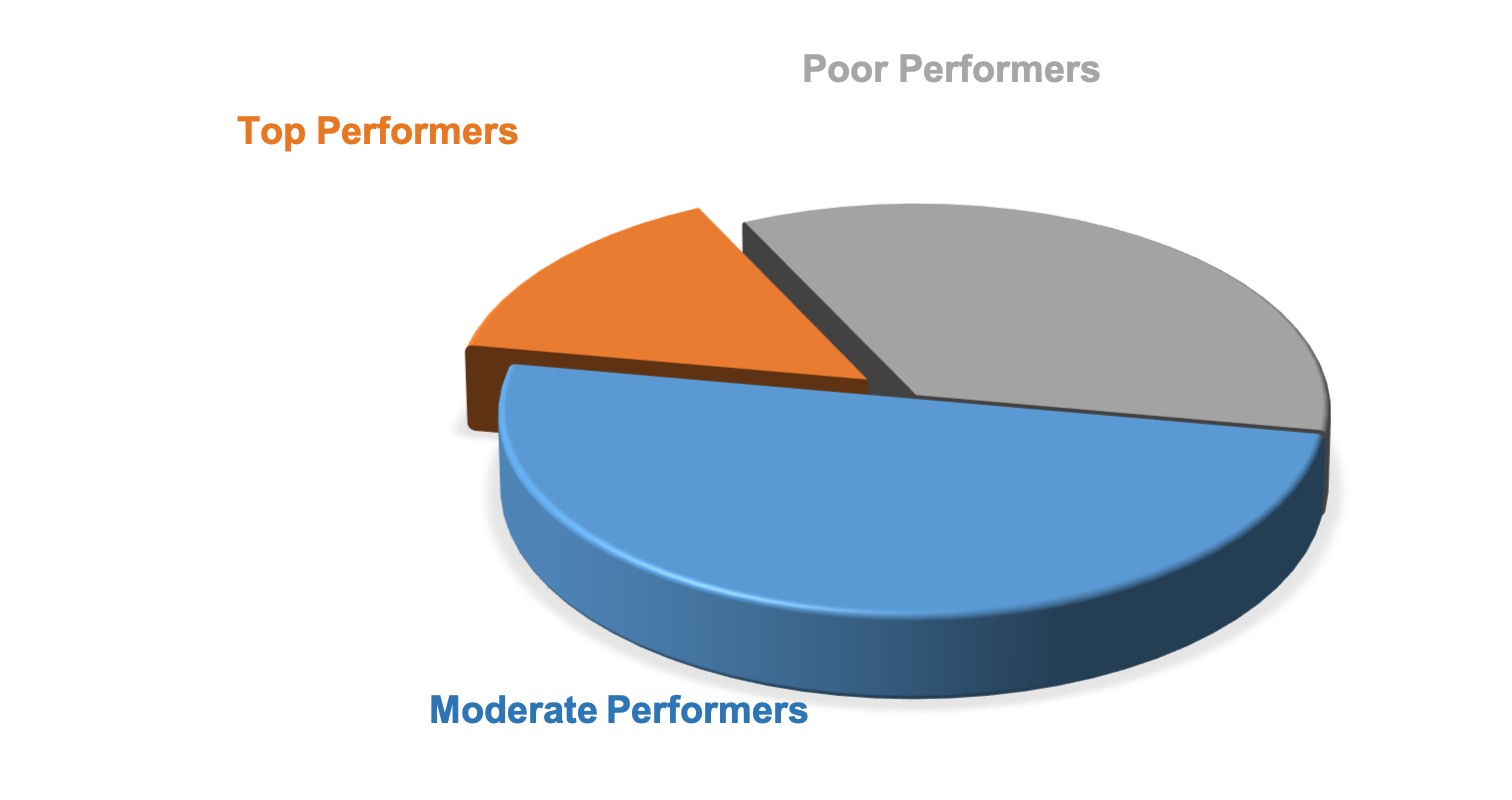

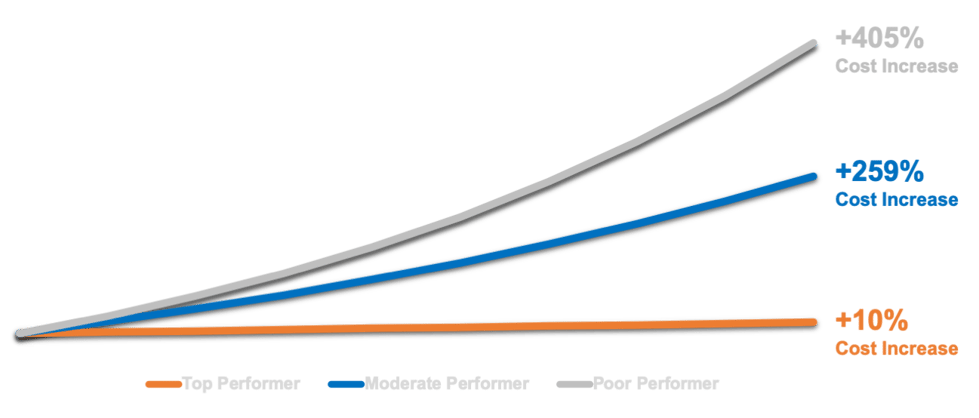

Not for everyone. Top performers get annual cost increases of just 0%-2%. That's 8%-13% less than the average company.

Top performers have an average annual cost increase of 0-2%.

Moderate and Poor Performers face 10%-15% annual increases.

Over 10 years, these small annual differences compound into a much bigger problem...

READY TO FIGHT BACK?

HNI works with high-performing companies to help them address the hidden risks in their business and avoid The Insurance Dependency Trap. This is done by proactively DE-RISKING their business so they can be less dependent on insurance.

HNI also offers the basic services of insurance and employee benefits. HNI has offices in Milwaukee, Chicago, Minneapolis, and Grand Rapids.