It’s no secret that the cost of employee benefits is increasing. But what’s often overlooked is the toll that these increases will take on your profitability in the coming years.

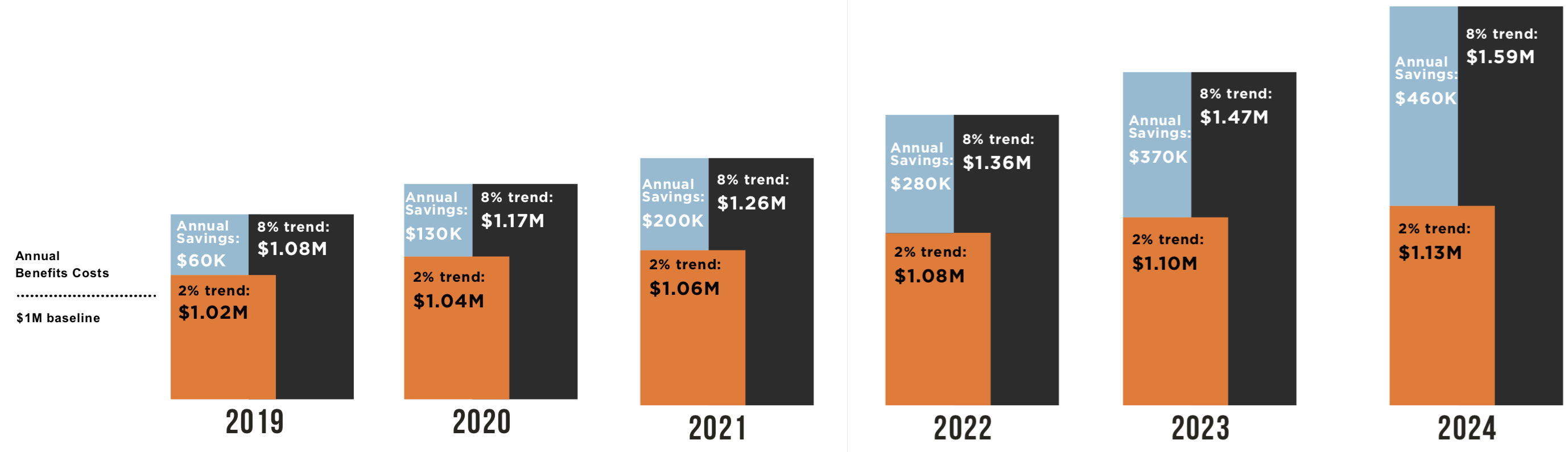

The difference between a 2% annual cost increase and the status quo (let’s call it 8%) is enormous. Over the next 5 or 10 years, that difference is measured in millions of dollars.

At HNI, we decided not to stand by and take another annual increase. Which is why we joined a community of leading employers and began self-funding our health care costs with the help of a captive.

What we want to share with you is how these companies are doing it. How they are building a multi-year strategy to implement the best ideas and how they are using data to continuously get better.

And how financing their benefits with a captive is empowering them to make 2% happen.

SPEAKERS

TOPICS COVERED

Spread the word: