As of January 2016, employers with 50 or more full-time employees, including full-time equivalent employees, are considered to be Applicable Large Employers (ALEs) and are subject to several complex Affordable Care Act (ACA) reporting requirements. For employers with 50 - 99 full-time or full-time equivalent employees, there is transition relief available from the ACA Employer Mandate penalties for 2015, but such employers must still complete and file Forms 1094-C and 1095-C on time.

As of January 2016, employers with 50 or more full-time employees, including full-time equivalent employees, are considered to be Applicable Large Employers (ALEs) and are subject to several complex Affordable Care Act (ACA) reporting requirements. For employers with 50 - 99 full-time or full-time equivalent employees, there is transition relief available from the ACA Employer Mandate penalties for 2015, but such employers must still complete and file Forms 1094-C and 1095-C on time.

In addition, related employers within a controlled group need to be aggregated for determining the number of full-time or full-time equivalent employees for the purpose of determining ALE status. If the controlled group has 50 or more full-time equivalent employees, then each separate entity (referred to as an ALE member) within the controlled group has this ACA reporting requirement even if one of more ALE member has less than 50 full-time equivalent employees.

Union employees may count toward the determination of whether or not an employer is an ALE.

ALEs must provide insurance coverage reporting to the IRS on every full-time employee they had during the past year as long as the employee was employed at least one month. In addition, the ALE or the ALE member must prepare and provide to each full-time employee a Form 1095-C. Form 1094-C is used by the employer along with the W-2 form for income tax and insurance reporting purposes. Form 1095-C indicates whether the full-time employee was offered coverage, the minimum value of self-only insurance coverage offered, and whether the employee's spouse and/or dependents were offered health coverage for each calendar month of 2015.

Employers that are not ALEs but sponsor self-insurance health plans still have reporting obligations as health coverage issuers. In addition, employers with self-insured group health plans will be required to identify each employee and/or spouse or dependent that was covered during each month of 2015, regardless of whether the employer is considered an ALE.

Should You Outsource Your ACA Reporting?

The IRS in September 2015 issued the final forms and instructions that employers will be required to use to satisfy the ACA reporting requirements. The IRS also released guidance regarding the new ACA Information Returns (AIR) system that may be used to file the reporting forms electronically. ALEs that have 250 or more Form 1095-Cs are required to file electronically.

The AIR system is complicated and the reporting process is time-consuming. In order to use the AIR system, ALEs must first register using the IRS's registration services process. This process (which should have been already started) involves applying for a Transmitter Control Code (TCC) that the ALE will receive in the mail. ALE's must also complete the AIR system's trial submission and testing process.

In order to properly complete ACA reporting, employers need to collect a significant amount of data and information from payroll and employee benefits departments, benefits enrollment systems, and third party vendors (e.g., insurance companies). This information will need to be compiled on Forms 1094-C and 1095-C. Employers must decide if they have the internal resources necessary to complete this mandatory reporting, or whether they need to engage a third party to prepare their ACA reports.

Employers who must outsource ACA reporting should have already selected a vendor. Ample time must be allowed to load workforce data and test the program software for preparing Forms 1094-C and 1095-C.

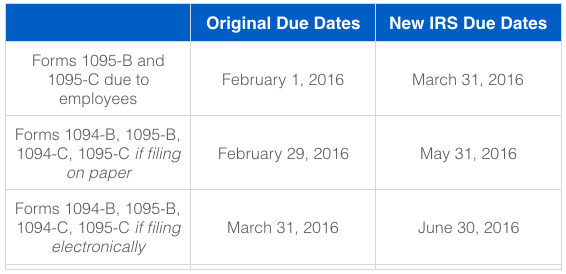

Timeline for Filing Reports and Distributing Statements to Individuals

IRS Notice 2016-4 recently extended key reporting deadlines.

What are the Penalties for Failed ACA Reporting?

IRS instructions for ACA reporting reflect applicable tax reporting penalties effective for 2015 filings, which if assessed, apply in addition to any Employer Mandate penalties that could be assessed. In general, Employer Mandate penalties apply if you did not offer insurance coverage to at least 95% (70% for 2015 only) of your full-time workforce, or if the coverage was not "affordable" as defined under the ACA. The Employer Mandate penalties are beyond the scope of this article but they can be significant if the employer is not in compliance with the mandate.

ACA reporting penalties may be reduced or waived for failures due to a reasonable cause or that are corrected in a timely manner. In addition, penalties will not be assessed for 2015 ACA reporting failures as long as the entities responsible for reporting show that they made good faith efforts to comply. This short-term penalty relief is available only for incorrect or incomplete information provided on 2015 ACA reporting forms and statements. There will be no relief from ACA penalties related to the failure to file on time or provide a required statement.

Penalties for failure to report or file can be significant. The fine for failing to provide mandated forms has been increased to $500 per return. Since a return must be provided to both the IRS and the full-time employee, a fine could be as high as $1,000 per full-time employee if you ignore the basic reporting requirements.

Next Steps for Employers

Failure to comply with ACA reporting requirements can be extremely costly for employers. If you have not already started the process nor engaged an outside vendor, it may be too late. Contact your benefits representative immediately to see if there are any options still available to help you through the process, as time is running out.