BARB RAND

BARB RAND

Compliance Advisor

There are two more health care reform requirements for employers to be aware of: IRC Section 6055 and IRC Section 6065. (IRC stands for Internal Revenue Code.) These filings aren't due until the beginning of 2016 (for coverage offered in 2015), but collecting the data you need to complete the forms will require some legwork that you can prepare for now by implementing new processes or HR technology.

These filings are designed to report information to the IRS about the health care coverage offered to full-time employees and their dependents. IRC Section 6055 requires reporting minimum essential coverage for the individual mandate, and IRC Section 6056 enforces employer-shared responsibility for applicable large employers (those with over 50 FTEs).

Following is a crash course on who needs to complete these forms and what information you need to make sure they're compliant. (The IRS has shared draft versions of these forms. Download PDFs of these draft forms below.)

| Who Does It Apply To | IRC 6055 (All-Sized Employers) | IRC 6056 (Only Applicable Large Employers [If Over 50 FTEs]) |

| Fully Insured Health Plans | Reported by insurer | Reported by employer |

| Self-Insured Plans | Reported by employer | Reported by employer |

What employee-specific information do I need to collect?

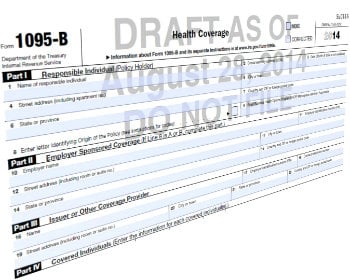

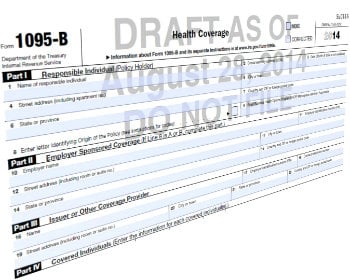

IRC Section 6055 calls for issuing separate information returns to each covered individual. For fully insured plans, Form 1095-B is the report issued by the insurer to individuals, and Form 1094-B is used to transmit the individual forms to the IRS. For self-insured plans, Form 1095-C is issued by the employer to covered individuals and Form 1094-C is used to transmit the individual forms to the IRS.

IRC Section 6056 requires reporting by applicable large employers and also calls for issuing separate returns to each individual (Form 1095-C) and, again, using a transmittal form (1094-C) to send these separate returns to the IRS. An applicable large employer that is fully insured only would complete Parts I and II of Form 1095-C. An applicable large employer that is self-insured would complete the entire Form 1095-C, which consolidates the employer's 6055 and 6056 reporting obligations on one form. Again, these are presently draft forms. Anyone wishing to submit comments about the draft forms may do so using this comment form.

When is the IRC Section 6055 reporting due?

Originally, the deadline for these reports was early 2015 for coverage offered in 2014. However, enforcement of penalties associated with the reporting now is delayed until early 2016 for coverage offered in 2015.

Despite the delayed enforcement, the IRS encourages early reporting for the coverage offered in 2014. In the preamble to the final regulations, the IRS notes, “Real-world testing of reporting systems and plan designs, built in accordance with the terms of these final regulations, through voluntary compliance for 2014 will contribute to a smoother transition to full implementation for 2015."

The deadline for issuing the separate reports to individuals is January 31 of the following year. The deadline for filing the reports with the IRS is February 28 of the following year (or, if filed electronically, March 31).

What employee-specific information do I need to collect?

6055 calls for: names, addresses, and social security numbers of employees and dependents covered under the health plan; and the specific months when they were covered at least one day. In addition, there is employer-specific information that must be provided, such as the employer name, employer identification number (EIN), the portion of the premium paid for by the employer, and whether the plan was enrolled in through a SHOP exchange.

6056 calls for more information. Because of this, the final rules on the filing say employers may use indicator codes to make the job easier. This form requires:

- the number of full-time employees and their names, addresses, and social security numbers for each calendar month

- proof that the employer offered coverage; provided minimum essential coverage; and whether it provided minimum value and met the 9.5 percent affordability test; and was offered to full-time employees and their dependents

- information about any waiting periods

Why will collecting this data be tricky?

6055 calls for dependent information, and 6056 calls for dependent election details. Most HR databases do not capture this intel. What's more, 6056 requires employees' details and coverage counts on a monthly basis, affordability tests, cost sharing, and recording the reason why coverage wasn't offered to certain employees.

Even if your organization qualifies for the simplified form (available for 6056), you'll still need some kind of electronic tracking to record the enrollment election/waiver for employees and dependents and a time stamp for this action.

These health care reform requirements for employers likely will require some long-term planning and technology investment. Difficult as they will be, your compliance is on the line, and you've got to push through.

How can I make this process easier?

You can try to qualify for a simplified reporting alternative, which would involve certification that a “qualifying offer” is made. A qualifying offer is, generally, an offer of coverage to full-time employees for all months during the year of minimum essential coverage providing minimum value at an employee cost for employee only coverage not exceeding 9.5 percent of the mainland single federal poverty line. A qualifying offer includes an offer of minimum essential coverage to employees’ spouses and dependents.

An even more simplified reporting alternative is available, for 2015 coverage only, for an employer that certifies that a qualifying offer is made to at least 95 percent of its full-time employees.

Additional details about the reporting and simplified alternatives can be found via a Department of Treasury news release.

What should I do next?

We suggest that you take a hard look at how you're going to collect the required information and how you'll produce the mandated employee statements. We also encourage your firm to consider qualifying for the simplified 6056 form. If your current HR technology system can't collect the necessary data, now is the time to start thinking about an upgrade or establishing alternative processes.

What other questions do you have about these health care reform requirements for employers? Have any choice tips to share? Please sound off in comments!

DISCLAIMER: We hope this blog post gave you an "Aha!" moment, but please don't hold it as legal or tax advice. This information is general in nature, and your specific situation deserves attention from a dedicated legal or tax advisor.

Related Posts:

5 Ways You Can Improve the HR Technology Experience

7 Clues You're Ready for New HR Technology

Health Care Reform News: Employer Mandate Delayed

Health Care Reform Timeline for Employers: Where We're Going

.png?width=69&height=53&name=Acrisure%20Logo%20(White%20Horizontal).png)

BARB RAND

BARB RAND![[ GET THE SLIDE DECK ] Doing More with Less: Developing a Self-Service Culture Using HR Technology](https://no-cache.hubspot.com/cta/default/38664/f2e2722d-0cb0-4c77-a560-76bc9edfc909.png)